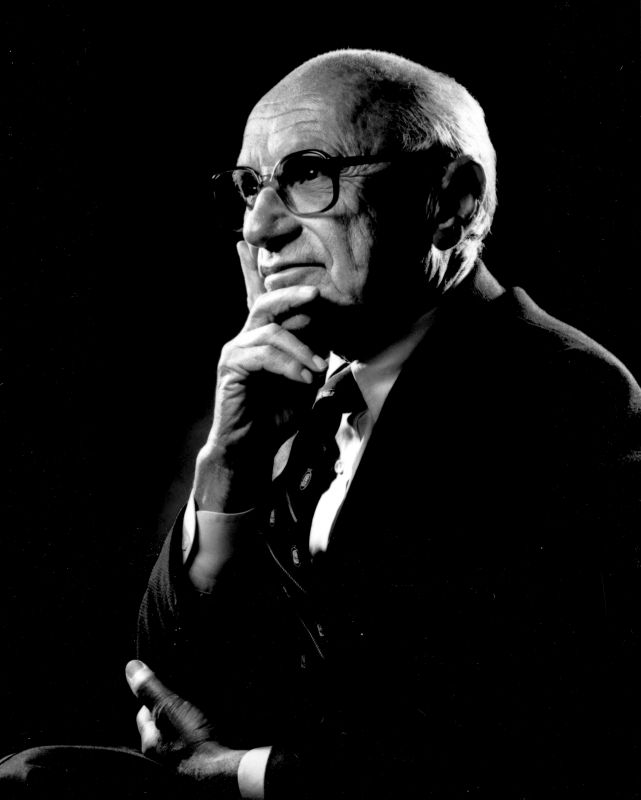

1970Milton Friedman writes an essay for The New York Times arguing that corporations have no responsibility to society, only to shareholders.

To celebrate our 45th anniversary, we’ve updated our Timeline of Corporate Governance, which has appeared throughout the years in our pages. Directors & Boards was founded during the creation and passage of the Foreign Corrupt Practices Act, which we believe to be the legislation that began the modern era of corporate governance responsibilities. We’ve continued to advocate for excellence in corporate governance through Sarbanes-Oxley, Dodd-Frank and the vigorous focus on ESG and DEI. While this timeline covers the past 45 years, former editor-in-chief Jim Kristie went back as far as 1912 in his first Timeline, which was published in our Fall 1997 issue.

Click here to view our Fall 1997 Timeline >>

How will this timeline look in five or 10 years? How will diversity mandates play out? How will increasingly diverse boards affect the art of governing the corporation? And what black swan(s) will we encounter that cause the creation of a new SOX or Dodd-Frank? Send your thoughts to David Shaw at dshaw@directorsandboards.com.

1970Milton Friedman writes an essay for The New York Times arguing that corporations have no responsibility to society, only to shareholders.

1976Directors & Boards magazine is established as “The journal of thought leadership in corporate governance.”

1976There are 4,943 public companies on U.S. stock exchanges.

1976Massive undisclosed payments made to foreign agents for business contracts are revealed at Lockheed Aircraft Corp., Exxon Corp. and others.

1976The term “corporate governance” first appears in the Federal Register, the official journal of the federal government.

1977Congress passes the Foreign Corrupt Practices Act, requiring publicly held corporations to maintain strict internal accounting controls to avoid further foreign bribery.

1977National Association of Corporate Directors (NACD) is established.

1977Harold M. Williams becomes SEC chairman and advocates for corporate power accountability and an ideal board consisting of independent directors with the CEO as the sole management board member and separate chairman and CEO roles.

1978NYSE adopts a rule that listed companies must have an audit committee composed solely of independent directors.

1978Business Roundtable publishes “The Role and Composition of the Board of Directors of the Large Publicly Owned Corporation” and the American Bar Association publishes the Corporate Director’s Guidebook.

1978SEC rules that proxy solicitations must disclose a description of significant economic and personal relationships existing between directors and the company on whose boards they serve.

1980Chrysler Corp., desperately in need of union concessions to keep operating, appoints UAW president Douglas Fraser to its board, the first union president appointment to a board.

1981American Law Institute begins a project, “Principles of Corporate Governance,” with an expanded definition of directors‘ functions and “duty of care” and a narrow definition of “the business judgment rule.”

1981Jim Kristie begins his tenure as editor-in-chief of Directors & Boards.

1982The “poison pill” is created by Martin Lipton, a Directors & Boards advisory board member and an attorney, as an anti-takeover weapon. Its first use is as a preferred stock dividend with El Paso Co.

1983Directors & Boards publishes excerpts of Douglas Ann Newsom’s journal of her first year as a director. Newsom is the first woman appointed to the board of energy company Oneok Inc.

1983SEC tightens its qualifications for shareholder presentation of proxy proposals, requiring higher voting hurdles for resubmission of proposals.

1984Stanford Business School establishes an educational program for board members of publicly held companies.

1985Smith v. Van Gorkom ruling by the Delaware Supreme Court challenges the standards of “informed” decision making by boards. Boards develop more elaborate processes of deliberation.

1985Institutional Shareholder Services, Inc. is founded by Robert A. G. Monks, former administrator of the U.S. Department of Labor’s Office of Pension and Welfare Benefit Programs, as a consultancy to institutional investors on corporate governance issues.

1985Moran v. Household International — The Delaware Supreme Court upholds a company’s right to adopt “shareholder rights plans” (aka “poison pills”).

1987Treadway Commission (The National Commission on Fraudulent Financial Reporting) issues its final report, calling for an enhanced oversight role for the audit committee.

1987California Public Employees’ Retirement System (CalPERS) sponsors shareholder proposals seeking rescission of “poison pills” at 30 companies, the first such governance proposal.

1989Valdez Principles are developed by a group of investor organizations as a code of environment conduct in response to the Exxon Valdez supertanker oil spill in Alaska; a campaign is undertaken to promote proxy resolutions with the Valdez Principles for board approval.

1990Pennsylvania passes the most restrictive anti-takeover law in the nation, adding an explicit statement that the interests of shareholders need not be the primary consideration in determining the best interest of the corporation.

1992SEC rules that shareholder resolutions concerning executive compensation would no longer be considered “ordinary business issues” excludable from proxy statements. It amends its proxy rules to make it easier for shareholders to communicate among themselves on management performance and matters presented for shareholder vote and to lower the regulatory cost of conducting a solicitation by management, shareholders and others.

1993Special Purpose Acquisition Companies (SPACs) are created by investment banker David Nussbaum and lawyer David Miller. SPACs, also called blank-check companies, are shell firms that list on a stock exchange with the sole purpose of combining with a private company to take it public.

1993 A big year for board muscle-flexing: CEOs exiting include IBM's John Akers, American Express's James Robinson III, Westinghouse Electric's Paul Lego, Borden's Anthony D'Amato and Kodak's Kay Whitmore.

1994U.S. Department of Labor issues clarifying guidelines urging pension plan managers to vote their proxies and to actively monitor the management of companies in which they invest.

1994IRS rules that compensation committees must have at least two outside directors, a response to increased criticism of CEO overpayment for non-performance.

1994GM publishes “GM Guidelines on Significant Corporate Governance Issues” to codify the board’s mission statement and governance standards.

1995Director compensation becomes a hot target of shareholder activism. Companies begin to drop director pension plans and increase the stock component of director pay.

1995Directors & Boards issues a special edition on the history of director compensation with Charles Elson — now Directors & Boards’ executive editor-at-large — Dennis Carey and John England, including the shift from all cash to a blend of stock and cash, with a bias toward company equity.

19967,322 domestic companies are listed on U.S. stock exchanges.

1996Financial Accounting Standards Board issues SFAS 125, which allows a “sponsor” to create a limited liability corporation, a “special-purpose entity” to which it can transfer assets and related debts.

1996Teamsters Union releases a study of “America’s Least Valuable Directors,” increasing shareholder activism.

1996Caremark International, Inc. Derivative Litigation is brought before the Delaware Court of the Chancery. The decision in Caremark clarifies the board’s duties in the context of its oversight activities.

1996Directors & Boards celebrates its 20th anniversary with a cover story from then-Lockheed Martin CEO Norman R. Augustine focused on governing in the age of rampant technology and globalism.

1997SEC announces it is again considering amending its shareholder proposal rule to make it easier to include a broad range of proposals in proxies.

1997Business Roundtable issues its Statement on Corporate Governance: “The substance of good governance is more important than its form; adoption of a set of rules or principles or of any particular practice or policy is not a substitute for and does not itself assure good corporate governance.” It also reverses previous positions and supports shareholder primacy.

1998SEC rules to allow shareholder resolutions pertaining to social issues including diversity and discrimination.

2000National Association of Corporate Directors joins with the International Women's Forum, an exclusive, invitation-only membership organization of about 1,000 internationally and politically positioned females, to promote women on boards of directors.

2001Charles Elson establishes Weinberg Center for Corporate Governance at the University of Delaware.

2001Accounting scandals at Enron, WorldCom, Global Crossing and Tyco result in the demise of Arthur Andersen, one of the “Big 5” accounting firms. The scandals cause billions of dollars in corporate and investor losses and impact financial markets and general investor trust.

Doug Mills/AP/Shutterstock

2002The Sarbanes-Oxley Act is passed in the wake of the Enron scandal to help protect investors from fraudulent financial reporting by corporations.

Above: President George W. Bush shakes hands with Sen. Paul Sarbanes, D-Md., right, as Rep. Mike Oxley, R-Ohio, applauds prior to signing the Sarbanes-Oxley Act in the East Room of the White House.

2003SEC approves NYSE and Nasdaq rules requiring a stricter, more detailed definition of independence for directors and requiring the majority of members on listed companies’ boards to satisfy that standard. Rule changes include a number of provisions that require and facilitate independent director oversight of processes relating to corporate governance, auditing, director nominations and compensation.

2004SEC approves a controversial rule requiring mutual fund boards to have independent chairmen; U.S. Chamber of Commerce commences a contentious battle with the agency to beat back the ruling (which, two years later, the SEC announces it will revisit).

2005SEC considers proposal to allow shareholders direct access to the company proxy to nominate candidates for board election.

2005U.N. Environment Programme publishes “A Legal Framework for the Integration of Environmental, Social and Governance Issues into Institutional Investment: A Report Produced for the Asset Management Working Group of the UNEP,” led by Freshfields Bruckhaus Deringer.

2005American Bar Association’s Corporate Laws Committee proposes model majority voting statute which is quickly adopted by Delaware.

2006Directors & Boards launches its “Directors to Watch” series, which highlights outstanding women and minority directors.

2006SEC approves the most sweeping overhaul of compensation reporting since 1992, taking into account fuller disclosure of perquisites, retirement benefits and total compensation.

2007The bottom falls out of the U.S. housing market, followed by a shortage of assets in the financial markets and the collapse of the financial sector, including banks, credit card companies and insurance companies. The Great Recession officially ends in June 2009.

2009Delaware corporate statute amended to allow Proxy Access and Proxy Reimbursement.

2010The Dodd-Frank Wall Street Reform and Consumer Protection Act targets the sectors of the financial system that were believed to have caused the financial crisis and adopts and federalizes certain governance reforms on compensation committees, say on pay and proxy access.

2011“Say on Pay” is introduced as a non-binding advisory vote by shareholders for or against named executive officer compensation.

2012The Ira M. Millstein Center for Global Markets and Corporate Ownership is established at Columbia Law School. (Pictured: Ira Millstein)

2014Directors & Boards’ parent company, MLR Media, launches the Private Company Governance Summit and Private Company Director magazine, providing private company boards with thought leadership and usable best practices.

20173,671 domestic public companies are listed on U.S. stock exchanges, about half the figure from 20 years earlier.

pictureforlife/Shutterstock.com

2017State Street Global Advisors installs “The Fearless Girl” statue facing Wall Street’s famous bull. The statue is part of a State Street campaign to pressure companies to appoint more women directors.

2017 Jim Kristie retires after 35 years at Directors & Boards’ editor-in-chief.

2018California passes a law requiring publicly held companies headquartered in the state to include at least one woman director on their boards. Colorado, Maryland, Illinois and New York have passed similar legislation.

2019Directors & Boards’ theme for the year, “The Character of the Corporation,” shapes the conversation around ESG and serving all stakeholders — not just stockholders. The year culminates in the first Character of the Corporation forum for sitting directors, including keynote interviews with the newly retired CEO and chairman of PepsiCo, Indra Nooyi, and Delaware Supreme Court Chief Justice Leo Strine.

2019Marchand v. Barnhill is brought before the Delaware Supreme Court after dismissal in a lower court. The supreme court reverses that decision and allows duty of loyalty claims against Blue Bell Creameries directors after listeria-contaminated ice cream from the company killed three people.

2019Business Roundtable updates its Statement on the Purpose of the Corporation, calling for a focus on all stakeholders, not only shareholders, with 181 CEOs signing on to the statement.

2019The number of U.S. public companies is on the rise again, with 4,266 listed.

2020California passes a law requiring publicly held companies headquartered in the state to include board members from underrepresented communities.

2021SEC approves the Board Diversity Disclosure Rule from Nasdaq, which requires corporations traded on the exchange to disclose the board’s gender, racial and LGBTQ+ diversity annually. If the board does not have the mandated diversity, it must publicly disclose why or run the risk of being delisted. The Alliance for Fair Board Recruitment files a legal challenge to the rule immediately.

2021Activist fund Engine No. 1, with just a 0.02% stake in Exxon, targets the oil giant over the shift away from fossil fuel dependency. (The investor thinks Exxon is moving too slowly.) At Exxon’s annual meeting, the fund gets three of its director nominees onto the board.